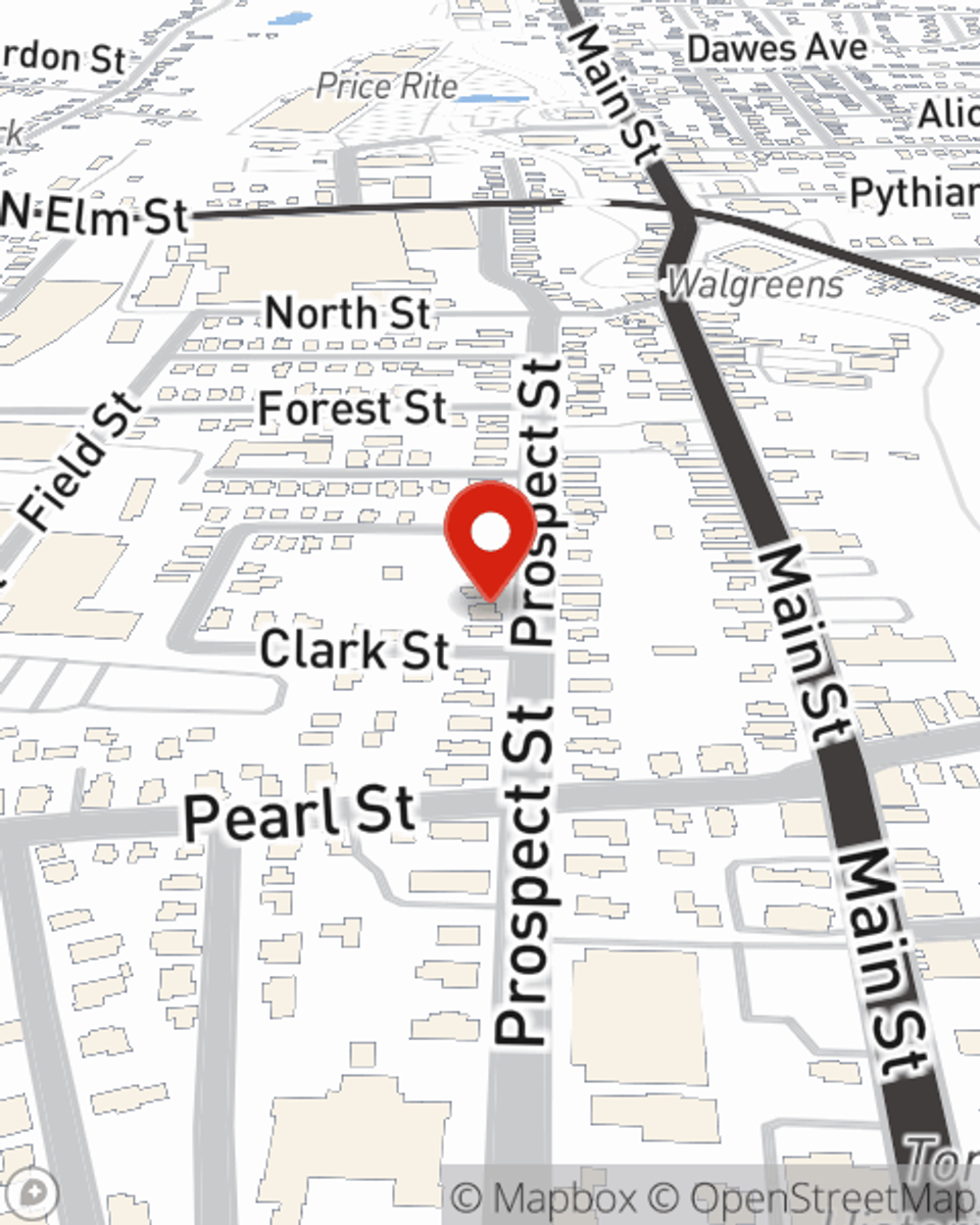

Business Insurance in and around Torrington

Get your Torrington business covered, right here!

Helping insure businesses can be the neighborly thing to do

State Farm Understands Small Businesses.

Operating your small business takes dedication, time, and outstanding insurance. That's why State Farm offers coverage options like business continuity plans, extra liability coverage, errors and omissions liability, and more!

Get your Torrington business covered, right here!

Helping insure businesses can be the neighborly thing to do

Small Business Insurance You Can Count On

At State Farm, apply for the fantastic coverage you may need for your business, whether it's an art school, an ice cream shop or a pizza parlor. Agent Amie Chasse is also a business owner and understands your needs. Not only that, but personalized insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage can't be beat.

Agent Amie Chasse is here to discuss your business insurance options with you. Visit with Amie Chasse today!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Amie Chasse

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.